Angola Inflation Drops to Below 14% in December 2022 – A 7-Year Low

source link: https://bitcoinke.io/2023/01/angola-inflation-in-december-2022/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Angola Inflation Drops to Below 14% in December 2022 – A 7-Year Low – BitcoinKE

The National Bank of Angola has cut its benchmark interest rate by 150 basis point to 18% down from 19.5% as inflation dropped again in December 2022.

The central bank Governor, José Massano, said the bank made the decision to cut the interest rate after inflation last month came in below the central bank’s forecast.

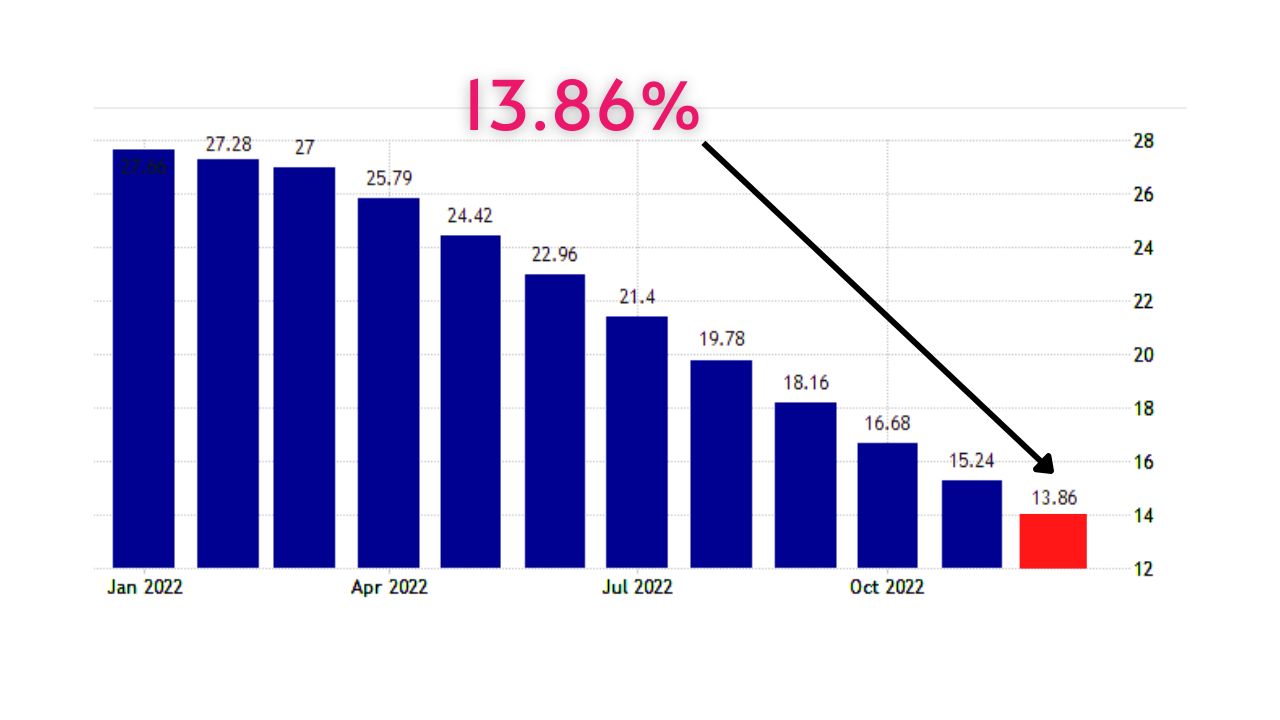

According to data from the country’s national institute, the annual inflation rate was 13.86% in December 2022, from as high as 27.66% in January with inflation dropping for 11 consecutive months in the oil rich nation.

The December 2022 rate was also the lowest reading since November of 2015 amid a broadly stable local Kwanza currency and as food prices continued to ease on the back of a strong harvest.

On a monthly basis, consumer prices inched up by 0.87%, the most in seven months, after increasing by 0.82% in the prior month.

Massano added that he expects inflation to drop further in 2023 to the 9% – 11% region. He also expects the economy to grow by 3.3% in gross domestic product (GDP) in 2023.

In September 2022, Angola cut its domestic rate by 50 basis points to 19.5% becoming one of the few central banks to be going that direction.

“Today, we have interest rates in Angola above 20%. So those are too high. And if we have room to keep on reducing them, we’ll do it,” Massano said at the time.

The action by the Central Bank of Angola in September 2022 came on the backdrop of the positive inflation data throughout 2022, at a time most African nations were dealing with rising inflation. This performance looks to be sustaining in 2023 while Angola was joined by several nations reporting better inflation numbers in December 2022.

These include:

- Namibia

- Mozambique

- Kenya

- Nigeria

- South Africa

- Uganda

- Ethiopia

- Rwanda

- Tanzania

- Senegal and

all which reported a drop in inflation in December 2022.

____________________________________

Follow us on Twitter for the latest posts and updates

Join and interact with our Telegram community

____________________________________

____________________________________

The Central Bank of Nigeria (CBN) Regulatory Sandbox Goes Live

The Sandbox application process is open to both existing CBN licensees (financial institutions with fintech initiatives) and other non-regulated technology companies intending to test innovative financial solutions, products, or services deemed acceptable by the CBN. However, the bank is more concerned with applications of novel technologies not covered by law.

The Central Bank of Nigeria (CBN) regulatory sandbox has gone live, the bank has announced.

#CBN's Regulatory Sandbox is LIVE!!

As an innovation-embracing financial institution, CBN is determined to support the development of new financial products and services that can improve how payment systems operate, mainly through digital channels. pic.twitter.com/mroqrjco39

— Central Bank of Nigeria (@cenbank) January 25, 2023

“As such, we invite participants in the financial system to submit Expressions of Interest to participate in the Regulatory Sandbox to explore novel applications of technology and innovation on behalf of our customers and stakeholders,” the bank said in a tweet thread.

According to CBN, the Regulatory Sandbox is a formal process for firms to conduct live tests of new, innovative products, services, delivery channels, or business models in a controlled environment with regulatory oversight.

The CBN’s Sandbox aims to boost innovation, increase financial accessibility, and protect consumers, all while offering a means of communication with fintech firms in the payments sector.

The Sandbox application process is open to both existing CBN licensees (financial institutions with fintech initiatives) and other non-regulated technology companies intending to test innovative financial solutions, products, or services deemed acceptable by the CBN.

However, the bank is more concerned with applications of novel technologies not covered by law.

“Innovative financial service/products deemed acceptable by the CBN and tests proposing non-regulated financial products and services using emerging technologies, i.e., Innovators whose proposed solution involves technologies which are currently not covered under existing CBN regulations. Tests are limited to payment products and services.”

Among the criteria for acceptance include being an innovative product or service with clear potential to:

- Improve accessibility, customer choices, efficiency, security and quality in the provision of financial services; or

- Enhance the efficiency and effectiveness of Nigerian financial institutions management of risks; or

- Address gaps in or open up new opportunities for financial benefits or investments in the Nigerian economy

The applicant should submit an application form along with all complete information and relevant details. Prior to submitting an application, the applicant can seek clarification regarding the sandbox by writing a mail to [email protected]

The CBN’s sandbox was initiated in 2021 with the publication of the Framework for Regulatory Sandbox Operations.

_____________________________________

Follow us on Twitter for the latest posts and updates

Join and interact with our Telegram community

_____________________________________

_____________________________________

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK