Hynix Posts Record Loss on Slump in Memory-Chip Prices

source link: https://finance.yahoo.com/news/hynix-posts-record-loss-slump-234042018.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Hynix Posts Record Loss on Slump in Memory-Chip Prices

(Bloomberg) -- SK Hynix Inc. stuck with plans to halve 2023 capital spending after reporting its biggest quarterly loss on record, hammered by a historic chip industry slump.

Most Read from Bloomberg

Slammed by a more than 50% slide in memory chip prices from a recent peak, the Apple Inc. supplier said Wednesday it is slashing output, capex and costs as it awaits a recovery in the second half of the year.

The world’s No. 2 DRAM maker reported a deeper-than-expected operating loss of 1.7 trillion won ($1.4 billion) for the three months ended in December on a 38% drop in revenue.

Despite rivals Micron Technology Inc. and Kioxia Holdings Corp. also cutting output, sector-wide inventory levels will keep growing, hitting a peak in the first quarter, before gradually falling towards the bottom half of the year, executives said. Hynix’s larger rival Samsung Electronics Co. had earlier dashed hopes for a large pullback in 2023 supply by saying it would keep capex at 2022’s level.

For now, pricing pressure on Hynix will continue, as demand for consumer electronics weakens and customers destock inventory, said Bloomberg Intelligence credit analyst Cecilia Chan. “SK Hynix is likely to see operations deteriorate further into 2023.”

Shares of Hynix pared earlier gains and were up around 0.5% during Wednesday morning trade in Seoul.

For months, the $160 billion memory industry has been reeling from a large imbalance between supply and demand. Memory makers are sitting on three to four months’ worth of inventory, while clients have yet to use up their stockpiles. South Korea’s exporters have been hitting the brakes in response to slumping consumer spending worldwide. The country’s exports declined 17% in January from a year earlier, largely due to a 44.5% drop in semiconductor exports.

Reuters

ReutersEU sets out green industry deal to take on U.S. and China

BRUSSELS (Reuters) -The European Commission on Wednesday proposed allowing increased levels of state aid so that Europe can compete with the United States as a manufacturing hub for electric vehicles and other green products and reduce its dependence on China. European Commission chief Ursula von der Leyen announced, as part of the plan, a repurposing of existing EU funds, faster approval of green projects and drives to boost skills and to seal trade agreements to secure supplies of critical raw materials. This is partly a response to multi-billion-dollar support programmes of China and the United States, including the latter's Inflation Reduction Act.

10h ago Associated Press

Associated PressSamsung's profit plummets amid global economic woes

Samsung Electronics said Tuesday its profit for the last quarter plummeted nearly 70% as a weak global economy depressed demand for its consumer electronics products and computer memory chips. The company’s operating profit of 4.3 trillion won ($3.5 billion) for the three months through December fell 69% from a year earlier, representing its lowest quarterly profit since the third quarter of 2014. The South Korean tech giant thrived through the first two years of the pandemic thanks to its dual strengths in parts and finished products, benefiting from robust demand for PCs, TVs and chips powering computer servers as the virus forced millions to work at home.

2d ago Reuters

ReutersBoeing to add 737 MAX production line as it plans output boost

SEATTLE/WASHINGTON (Reuters) -Boeing Co told employees on Monday that it will add a new 737 MAX production line in Everett, Washington, in mid-2024 as it plans to ramp up deliveries of its best-selling plane. Boeing Commercial Airplanes Chief Executive Stan Deal said in an email reviewed by Reuters that the new line will be its fourth for the narrow-body 737 MAX and is needed because of "strong product demand." The company is reactivating its third 737 MAX line in Renton, Washington, Deal added.

2d ago Reuters

ReutersSamsung to keep up chip investment, undeterred by 8-year-low profit

South Korea's Samsung Electronics Co Ltd on Tuesday indicated it has no plan to cut investment in chips this year, even as a weak global economy condemns the industry to its worst downturn in over a decade. The guidance bucks a broader industry trend to scale back spending and output, fanning concern that the world's biggest memory chipmaker intends to draw on its deep pockets and superior profit margins to gain market share from smaller peers. "Samsung might be seeing this time as a good opportunity to increase market share, which should help it in the long term, at the expense of SK Hynix and Micron," said analyst Choi Yoo-june at Shinhan Securities.

2d ago GOBankingRates

GOBankingRatesWhat Is ChatGPT? And How Can It Help You Get Work Done?

ChatGPT, a chatbot created by OpenAI that launched late last year, has been making headlines and, in some cases, creating them. Check Out: GOBankingRates' Best Online and Neobank Savings Accounts of...

19h ago Reuters

ReutersTokyo booms for shareholder-relations advisers as activists raise pressure

A rising wave of shareholder activism has turned Tokyo into a growth market for businesses that offer advice on shareholder relations, as corporate Japan scrambles for help to deal with investors who are no longer silent. The growing presence of such advisers, including new entrants, shows how Japanese companies are more actively addressing concerns about weak governance, poor allocation of capital and chronic stock underperformance - even those that have not yet been targeted by activists. With about half of its companies trading below their book value, Japan has become one of the world's most popular destinations for activists looking for targets with big potential for change.

15h ago Bloomberg

BloombergAdani Group Bonds Slide as Margin Loan News Sours Sentiment

(Bloomberg) -- The dollar bonds of Adani Group companies slid, reversing their earlier gains, on news that Credit Suisse Group AG’s private banking arm stopped accepting the debt issued Indian tycoon Gautam Adani’s empire as collateral for margin loans. Most Read from Bloomberg8,000 Layoffs Don’t Exactly Scream Family ValuesNational Archives Releases Records Tied to Trump Classified DocumentsPutin’s War in Ukraine Pushes Ex-Soviet States Toward New AlliesSony Slashes PlayStation VR2 Headset Outp

4h ago Yahoo Finance Video

Yahoo Finance VideoChip stocks ‘may have seen the bottom’ in October, analyst says

Great Hill Capital Chairman Thomas Hayes joins Yahoo Finance Live to discuss semiconductor demand, chip stocks, and the outlook for the industry despite macro economic headwinds.

22h ago The Wall Street Journal

The Wall Street JournalMemory-Chip Makers Face a Prolonged Price Slump

Prices of the chips are expected to keep falling in the first half of 2023, putting more pressure on an industry that has already cut investments and jobs.

2d ago Bloomberg

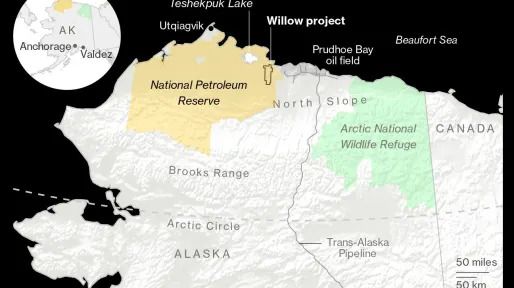

BloombergBiden to Signal Alaska Oil Project Support, Defying Greens

(Bloomberg) -- The Biden administration is on track to telegraph support for a scaled-back drilling plan at ConocoPhillips’s proposed Willow project in northwest Alaska, over the objections of environmentalists who say the world can’t afford to burn the estimated 600 million barrels of oil it could yield.Most Read from Bloomberg8,000 Layoffs Don’t Exactly Scream Family ValuesNational Archives Releases Records Tied to Trump Classified DocumentsPutin’s War in Ukraine Pushes Ex-Soviet States Toward

11h ago Bloomberg

BloombergMalaysia’s Anwar on Being PM, Corruption and China Ties: Q&A

(Bloomberg) -- Malaysian Prime Minister Anwar Ibrahim demanded Goldman Sachs Group Inc. honor its settlement with the government for its role in the 1MDB scandal and vowed to gradually lower the nation’s debt in an interview with Bloomberg Television’s Haslinda Amin. Most Read from Bloomberg8,000 Layoffs Don’t Exactly Scream Family ValuesNational Archives Releases Records Tied to Trump Classified DocumentsPutin’s War in Ukraine Pushes Ex-Soviet States Toward New AlliesSony Slashes PlayStation VR

13h ago Reuters

ReutersAnalysis-European debt sales break January record in a tricky year

European borrowers sold a record 280 billion euros ($304 billion) of debt in January, in a jump outpacing U.S. peers, to take advantage of tumbling borrowing costs and better-than-expected economic conditions. January's figures follow a year that saw the biggest jump in government borrowing costs in decades - from the United States to Asia and Europe - as inflation soared. "Everything that we've seen so far indicates 2023 is not going to be as difficult as people feared it would be," said Philip Brown, managing director, sovereign capital markets at Citi.

8h ago MarketWatch

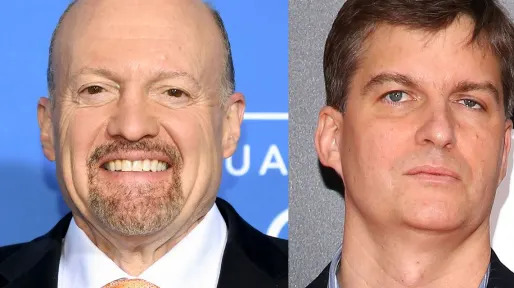

MarketWatchMichael Burry says sell and Jim Cramer says buy. As the Fed meets, here’s how they both could be wrong on stocks.

Michael Burry, the hedge-fund manager at Scion Asset Management who correctly forecast the 2008 financial crisis, on Tuesday night sent out a one-word tweet: “Sell.” Burry didn’t elaborate, but it’s not hard to fill in the blanks. Assets like bitcoin and ARK Innovation ETF surged in January, in a seeming dash for trash on the view the Fed’s going to pivot to rate cuts soon, which is a lot to stomach for a value-focused investor like Burry.

3h ago Motley Fool

Motley Fool1 Reason to Buy Novavax in 2023 and 2 Reasons to Sell

Novavax (NASDAQ: NVAX) has offered investors just such a ride over the past few years. Initial gains came as investors bet on Novavax's chances of bringing a coronavirus vaccine to market; declines occurred after the vaccine entered the market later than rival products did. Now, as we start a new year, you might be wondering what to do about Novavax.

4h ago Zacks

ZacksThermo Fisher Scientific (TMO) Surpasses Q4 Earnings and Revenue Estimates

Thermo Fisher (TMO) delivered earnings and revenue surprises of 4.05% and 10.55%, respectively, for the quarter ended December 2022. Do the numbers hold clues to what lies ahead for the stock?

2h ago Zacks

ZacksBull of the Day: Halliburton (HAL)

Strong cash flow from oil & gas services growth has analysts raising price targets for 30% upside

4h ago Motley Fool

Motley Fool3 Juicy Dividend Stocks in Warren Buffett's Secret Portfolio to Buy in February

Want to know which stocks Warren Buffett owns? Many investors don't realize that there's another group of stocks Buffett owns in addition to the stocks listed in Berkshire's 13-F documents. New England Asset Management (NEAM) is an investment firm that's a wholly owned subsidiary of Berkshire Hathaway.

4h ago Zacks

ZacksGSK (GSK) Q4 Earnings and Revenues Top Estimates

Glaxo (GSK) delivered earnings and revenue surprises of 8.47% and 4.31%, respectively, for the quarter ended December 2022. Do the numbers hold clues to what lies ahead for the stock?

2h ago MarketWatch

MarketWatchAmazon expected to post first unprofitable year since 2014 and worst loss since the dot-com bust

Amazon.com Inc. is expected to reveal its first unprofitable year since 2014 this week — and expectations for the year aren't headed in a positive direction.

18h ago Barrons.com

Barrons.comAltria Unveils $1 Billion Stock Buyback as Earnings Top Estimates

The cigarettes company reported adjusted earnings per share of $1.18 on revenue of $6.1 billion in the final three months of the year.

16m ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK