'They've gone too far': How Spotify dug a giant hole — and how it can dig itself...

source link: https://finance.yahoo.com/news/spotify-stock-2022-decline-what-happens-next-133312247.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

about 6%, after the company

'They've gone too far': How Spotify dug a giant hole — and how it can dig itself out

On February 19, 2021 Spotify (SPOT) shares closed at a record high of $364.59. The company's market cap was north of $69 billion.

Today, the stock is trading below $80 a share, down roughly 70% in 2022 and off nearly 80% from that record close. Its current market cap? $15 billion.

In the last several years, Spotify has sought to broaden its business from one that charges users to stream music into the leading business in the entire audio market.

"We believe our market that we're going after is audio," Spotify CEO Daniel Ek said in a 2019 interview. "And that's going to be at least a billion, probably 2 or 3 billion people around the world, that would want to consume some form of content like that on a daily or weekly basis."

Ek said if the company is going to "win that market," meaning audio, they'd need "at least a third" of this multi-billion user opportunity. "We're still very early days in our journey," Ek said.

In the intervening years, Spotify has spent $1 billion pushing into the podcast market, signing on celebrities like the Obamas, Prince Harry, and a Kardashian. The company paid $230 million to acquire podcast studio Gimlet in 2019. Spotify then paid a reported $200 million to bring Joe Rogan exclusively to the platform, and another $200 million for The Ringer in 2020.

But after a disastrous 2022 for investors, Spotify's dive into podcasting raises key questions about the company at large:

Does the business model work?

How long until sustained profitability?

Is the streaming service losing core appeal for the younger audiences, who are the most avid music consumers?

Has its CEO lost credibility with investors?

The answers to these questions hold the key to whether Spotify can mount a turnaround in the eyes of investors in the years ahead.

Peak investment year

Spotify's most recent results once again disappointed on the bottom line, after the platform reported a wider-than-expected loss of ($0.99) per share in the third quarter and another quarter of declining gross margins, which came in at 24.7%, missing expectations for 25.2%.

Yahoo Finance

Yahoo FinanceTesla stock's biggest bull is now pounding the table after December's big rout

A Tesla bull tries to be a hero on the plunging stock price.

11h ago Decrypt Media

Decrypt MediaUS Department of Justice Investigating Massive FTX Hack: Report

An estimated $650 million worth of crypto went missing after FTX declared bankruptcy, and now U.S. authorities are reportedly investigating.

1d ago Yahoo Sports

Yahoo SportsOregon one-ups wild interception with late drive, dramatic extra point to top UNC in Holiday Bowl thriller

Oregon rallied for a wild win over North Carolina in San Diego.

19h ago Yahoo Finance Video

Yahoo Finance VideoAmerica's wealthiest lose $660 billion in 2022: Report

Yahoo Finance Live's Brian Sozzi and Brad Smith break down the charts of the day.

5h ago Yahoo Finance

Yahoo FinanceThe Dow crushed tech stocks by the widest margin in 20 years: Morning Brief

What to watch in markets on Thursday, December 29, 2022.

11h ago TheStreet.com

TheStreet.comGE Is Not a Lost Cause as Healthcare Spinoff Gets Set to Join S&P 500

GE will ultimately break into three separate, independent, publicly traded companies. Next week Healthcare will be the first to be spun off.

7h ago Yahoo Sports

Yahoo SportsSpread Options: College football bowl game best bets, part 4

We've reached the home stretch of the college football season.

7h ago Yahoo Finance

Yahoo FinanceWall Street's 2022 stock market forecasts were way off. Here's what they see in 2023: Morning Brief

What to watch in markets on Wednesday, December 28, 2022.

1d ago MoneyWise

MoneyWiseDo you fall in America's lower, middle, or upper class? Here's how your income stacks up compared to the rest of the US population

And what it means for your ability to build wealth.

8h ago Motley Fool

Motley FoolWhy Taiwan Semiconductor, Intel, and Qualcomm Stocks Popped Today

All's well that ends well in the stock market -- and as trading winds down in what has been a miserable year for semiconductor investors, shareholders of Taiwan Semiconductor Manufacturing (NYSE: TSM), Intel (NASDAQ: INTC), and Qualcomm (NASDAQ: QCOM) are getting a reprieve of sorts. Qualcomm is gaining 2.9%, and Intel is up 2.2%.

4h ago Motley Fool

Motley Fool"Risk On" Trade Pushes Carvana, Silvergate, and Skillz Higher Today

The three stocks that caught my eye were Carvana (NYSE: CVNA) jumping by as much as 17%, Skillz (NYSE: SKLZ) popping 14.9%, and Silvergate Capital (NYSE: SI) gaining 7.3%. The broad market was rising Thursday in part because interest rates on bonds have dropped, which often correlates with a rising stock market. Skillz and Carvana specifically are burning cash even as their stocks fall and their growth slows.

2h ago Benzinga

BenzingaWarren Buffett Ditched His Flip Phone for an iPhone in 2020 and Drinks 5 Cans of Coke a Day — That's What Makes Him One of the Greatest Investors of All Time

Business magnate Warren Buffett is widely regarded as one of the greatest investors of the modern-day world. His seemingly unmatched and consistent value-investing strategies have earned him the title of Oracle of Omaha. Many of his investing strategies are known, but there is one that is often overlooked yet incredibly important. It’s a lot more prevalent in the startup investing world — one customer can mean all the difference for a startup but not necessarily for public companies. What happen

5h ago Motley Fool

Motley Fool3 High-Yield Dividend Stocks to Supercharge Your Passive Income Portfolio

All three of these high-yield dividend stocks have a long history of annual payout raises and an ability to raise their distributions without breaking their balance sheets. Shares of AbbVie (NYSE: ABBV) have risen more than 50% from a low point in October. Right now, AbbVie's dividend doesn't offer much more than a savings account.

12h ago Motley Fool

Motley FoolWhy EV Start-up Canoo's Shares Popped Today

Investors in Canoo (NASDAQ: GOEV) have had a rough year in 2022 with the stock plunging by 85%. After popping 8.4% early Thursday, Canoo stock was holding on to a gain of 6.5% as of 12:30 p.m. ET. One bit of news that might have investors more positive on the stock is a new report from EV sector site Electrek.

4h ago Insider Monkey

Insider Monkey12 Best 52-Week High Stocks To Buy Now

In this article, we will take a look at the 12 best 52-week high stocks to buy now. If you want to see more stocks in this selection, go to the 5 Best 52-Week High Stocks To Buy Now. The equity markets have been taking a beating this year as the Dow Jones Industrial Average […]

20h ago TipRanks

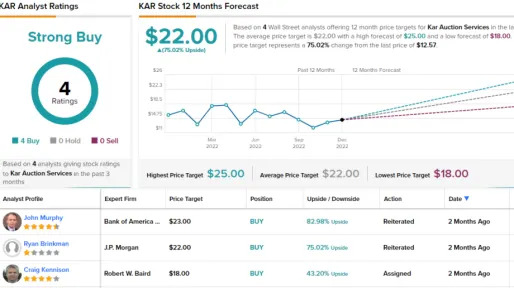

TipRanksJ.P. Morgan Sees 70% Upside for These 2 Auto Stocks

There’s been a lot of talk about the downward economic pressures that have pummeled the markets in 2022 – maybe too much such talk. Yes, the S&P 500 is down almost 21%, and the NASDAQ is down 35%, but investors can still find sound opportunities. J.P. Morgan analyst Ryan Brinkman has been sorting through the automotive industry stocks, and he’s found several that are worth a closer look. So let’s do just that. We know that the auto industry has its own particular headwinds, including the ongoing

13h ago Yahoo Finance Video

Yahoo Finance VideoCal-Maine Foods miss on earnings amid higher egg prices

Yahoo Finance Live anchors discuss the decline in stock for Cal-Maine Foods despite topping revenue expectations.

7h ago Motley Fool

Motley FoolWhy Shares of SoFi, Lemonade, and Upstart Are Rising Today

Shares of several popular fintech stocks rode the wave upward with the broader market Thursday after new data from the Labor Department indicated that the red-hot U.S. job market may be cooling a bit. As of 12:30 p.m. ET, shares of one-stop-shop financial services company SoFi (NASDAQ: SOFI) were trading nearly 4% higher, artificial intelligence-assisted lender Upstart (NASDAQ: UPST) was up by more than 4%, and insurtech company Lemonade (NYSE: LMND) was up by more than 5.5%. Investors rejoiced after new unemployment claims came in at 225,000 for the week that ended Dec. 24 -- 9,000 higher than the prior week and slightly above the consensus estimate.

3h ago Motley Fool

Motley Fool2 No-Brainer Warren Buffett Stocks to Buy Hand Over Fist for 2023

The Federal Reserve gave the stock market a shock recently as the central bank raised interest rates once again, taking its benchmark rate to its highest level in 15 years. The Fed also suggested that it would keep raising rates in 2023 to bring down inflation. The Fed's hawkish stance sent equities tumbling, as it was expected that the central bank would dial down rate increases in 2023 thanks to signs of cooling inflation.

7h ago Motley Fool

Motley FoolWhy Palantir, C3.ai, and Shopify Stocks All Gained Ground Today

The recent volatility that has plagued the major stock market indexes continued this week. After several days of declines, Wall Street was finally able to mount a rally Thursday as investors digested the latest unemployment report, which brought some (potentially) good news. The Federal Reserve Bank's campaign of rising interest rates may finally be cooling the overheated economy -- at least if the job numbers are any indication.

3h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK